That which is seen and that which is unseen by the Fed

Friday, February 3, 2012 at 04:45PM

Friday, February 3, 2012 at 04:45PM The testimony of Ben Bernanke yesterday (2/2/2012) to the Committee on the Budget of the U.S. House of Representatives was marked by an assertion as to the health of the US capital markets, that in response to a question that cited an opinion piece in the WSJ by Kevin Warsh excerpted below:

"Private investors are crowded out of the market when the Fed shows up as a large and powerful bidder. As a result, the administration and Congress make tax and spending decisions—with huge implications for our standard of living—with heightened risks around future funding costs."

The transcript of the testimony has not yet been published as of this writing, so we quote, sort of, Bernanke's response:

“The capital markets are all okey dokey. Never better. Next question.”

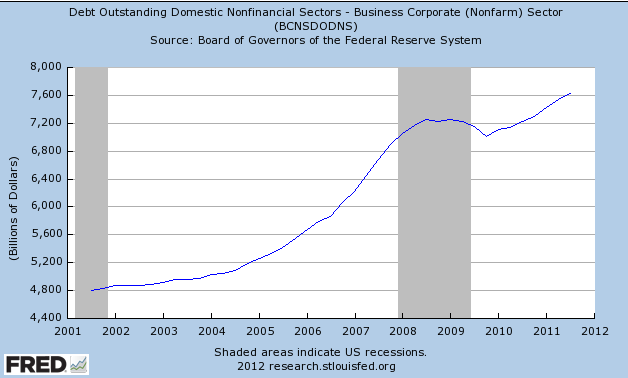

We return to that issue because we disagree. We think the narrow context of his response is facially misleading. First, we stipulate the US corporate debt market is robust (note the last data point is 2011-07-01)

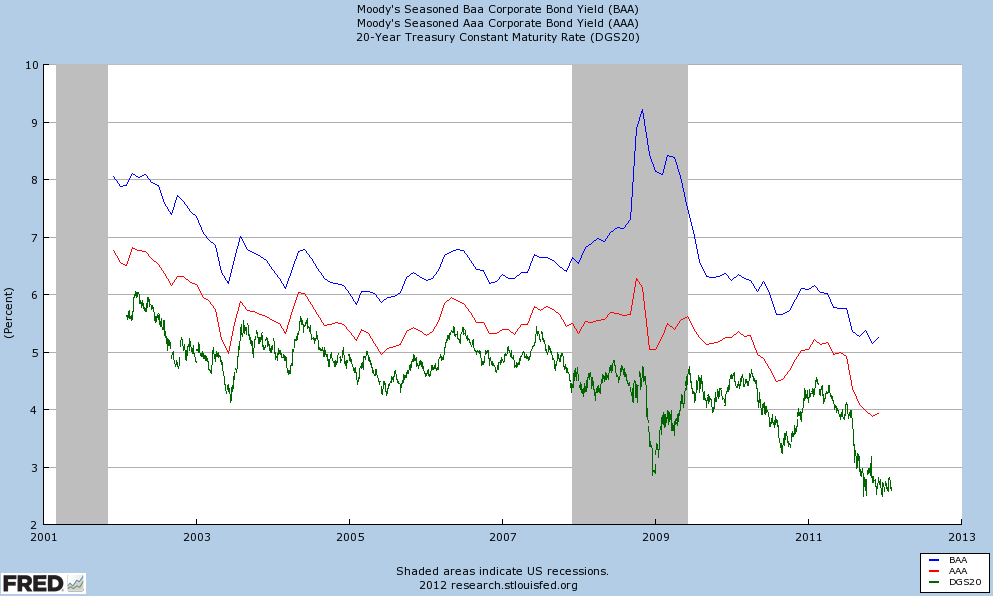

and spreads seem to be behaving reasonably well. And why not? It's free capital. Corporations have been stacking up cash as they are leery of the performance risk of banks as a source of liquidity and hesitant to commit capital in an uncertain tax and regulatory environment.

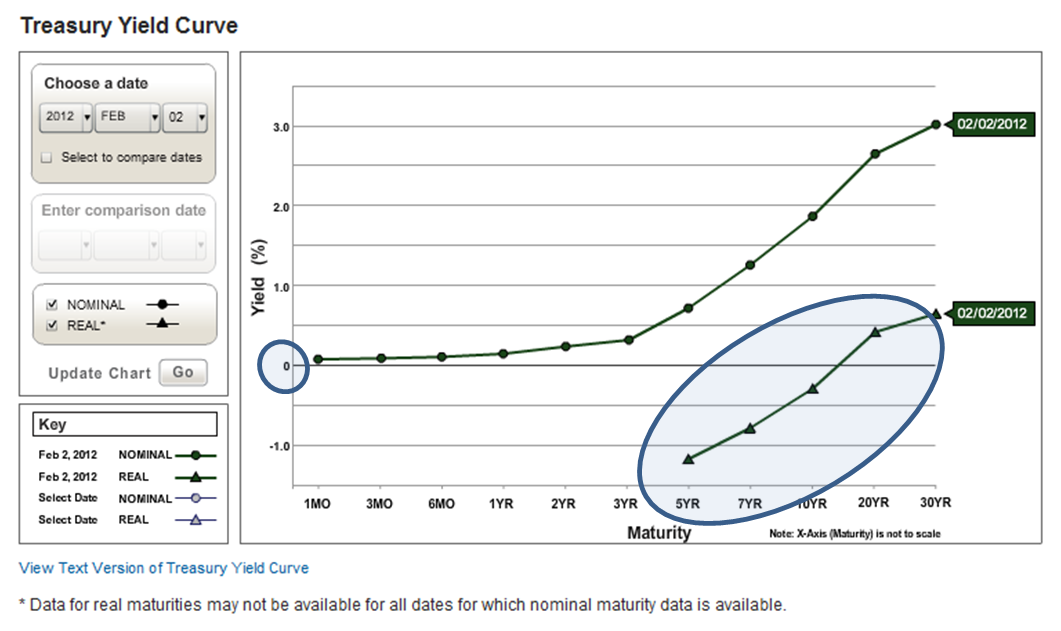

But consider that all corporate spread product is priced from Treasuries, and here is where it starts to fall apart. We have artificially low rates with negative real Treasury rates for all maturities of less than an ~ 15 years. The real 20 year US treasury rate for the week of 2/1/2012 was .42%.

Let’s think about this. Who benefits from the artificially low rates? The Fed’s manipulation of rates is an outright subsidy to any & all borrowers of US $ including US & foreign corporations, sovereign states, banks, obligors of credit card debt, mortgage borrowers of recent vintage, and the US Treasury itself. That’s pretty clear. Who pays for the subsidy? The subsidy is paid by investors or savers. That means Grandma & Grampa, your parents, your savings for your children’s education, pensions of every dimension, insurance companies, annuities, investors in mortgage of any vintage, and your very own bond allocation in your 401K or IRA … just to name a few.

There is no free lunch, and distorting the mechanics of how the country (and the world) allocates capital to productive assets will likey be a costly one... again. We can say with certainty it is not cost & risk free. To explore the inequities and hidden costs of subsidies we recommend That Which is Seen, and That Which is Not Seen, IX. Credit by Frederic Bastiat, 1850.

First, the facts. Look at the rate structure. We have highlighted the real rates in the picture below (today from the US Treasury website):

Markets, markets do not exist in one dimension. They exist in & around the intersections of the bids and offers, at the meetings of the views of issuers and the investors, and all the data points around those meetings. Any reasonable assessment of the health of any market requires a look at both sides. Anyone who has sat on an underwriting desk knows that before you commit to underwrite any security you better know with precision and confidence where the product is coming from; who’s going to buy it, at what price; and how long it’s going to take to move it. Risk is then defined as “If the bonds don’t go, I go.”

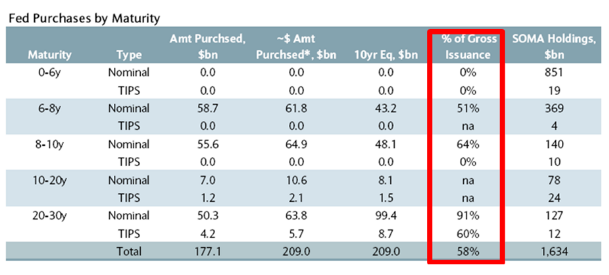

So, examine for yourself. See if everything is in fact okey dokey or not:

Source: graphic from Under Twist, The Fed Has Purchased 91% of All Gross Issuance in Long Dated US Treasurys

Yes, you read correctly. 91% of issuance of nominal long term Treasury bonds was purchased by the Fed. An unsophisticated primitive might describe that as the government buying bonds from itself for which privilege it pays the Primary Dealers thereby securing the favor of their support in various fashions and other fora. But let's stay focused on the inference that other investors (meaning every economic entity on the planet except the Fed) weren’t so keen & bought only 9% of the stuff. Have you ever been to an auction like that? Now, let us recall Mr. Bernanke’s pronouncement that the markets are okey dokey.

At this point we call to mind the joke about the elderly bucolic gentleman who, when presented with a thermos concluded it must be the world's greatest invention. “You put hot stuff in it, it stays hot. You put cold stuff in it, it stays cold. How do it know?” We would apply the same logic to Mr. Bernanke’s assessment and see, so to speak, if it holds water.

Others have been less kind:

We don't have a market of rational players any more - the entire market is merely one irrational player, whose biggest counterparty incidentally, the ECB, is beyond broke. Finally, what happens to the Fed's balance sheet when interest rates start rising? Holding a portfolio with a duration greater than it has ever been, the DV01 is currently well over $2 billion (i.e. a $2 billion loss on every basis point increase in rates). And rising.

source: Zero Hedge, Under Twist, The Fed Has Purchased 91% of All Gross Issuance in Long Dated US Treasurys

And having cited the need to include both perspectives, the bid and the offer, we would be remiss to exclude Bill Gross who runs the largest fixed income book in this country (and we believe, the world) and last year dumped, and publicly so, pretty much every Treasury bond he could:

When all yields approach the zero-bound, however, as in Japan for the past 10 years, and now in the U.S. and selected “clean dirty shirt” sovereigns, then the dynamics may change. Money can become less liquid and frozen by “price” in addition to the classic liquidity trap explained by “risk.”

Even if nodding in agreement, an observer might immediately comment that today’s yield curve is anything but flat and that might be true. Most short to intermediate Treasury yields, however, are dangerously close to the zero-bound which imply little if any room to fall: no margin, no air underneath those bond yields and therefore limited, if any, price appreciation. What incentive does a bank have to buy two-year Treasuries at 20 basis points when they can park overnight reserves with the Fed at 25? What incentives do investment managers or even individual investors have to take price risk with a five-, 10- or 30-year Treasury when there are multiples of downside price risk compared to appreciation? At 75 basis points, a five-year Treasury can only rationally appreciate by two more points, but theoretically can go down by an unlimited amount. Duration risk and flatness at the zero-bound, to make the simple point, can freeze and trap liquidity by convincing investors to hold cash as opposed to extend credit.

Where else can one go, however? We can’t put $100 trillion of credit in a system-wide mattress, can we? Of course not, but we can move in that direction by refusing to extend maturities and duration.

source: Bill Gross in Life & Death Proposition

To translate: credit creation and provision of liquidity can work in reverse if investors decide not to play, which can happen. Witness below our very own modest manifestation of the precise phenomena Mr. Gross was referring to, a refusal to extend duration:

We do think one needs be cautious about fixed income strategy. The Fed is, of course, trying to drive investors out the yield curve into the killing fields of future inflation. It creates a dilemma: stay short & earn nothing or go long & get slaughtered. It's a real problem for the elderly or others living on fixed income, including many endowments. We thank Bernanke for the invitation, but we'll pass. We've had a creeping bias to higher quality, short duration, and TIPS for some time and intend to keep it

source: WWB's Dynamite in the hands of children, Friday, February 5, 2010 at 09:47AM

One wonders how the Fed can honestly say the capital markets are robust and well-functioning when there is no market check on the prices; a growing use of gold as a currency store of value; a loss of the AAA status of the United States; and another downgrade of our credit in the works, that driven by the conspicuous absence of a sensible resolution to known large scale fiscal problems with predictable adverse outcomes?

We"ve seen this movie before. Remember the real estate bubble? "Which one?" the astute reader will ask. No, not Barney Frank's, Chris Dodd's and Greenspan's. We mean the one that destroyed the entire savings & loan industry and every dime of capital in it. The cost of this adventure in corruption and malfeasance, if memory serves, was approximately $23,000 ($49,680 in today's dollars) for every man, woman & child then in the country.

To summarize the state of affairs in 1985 we exerpt below from Thrift Market Review, June 13, 1985, an internal memo (prepared by yours truly) for executive management of the then Irving Trust Company. Thematically, it will sound very familiar to the other more recent and continuing real estate crisis or the Euroland crisis or any other financial crisis. Just change the dates, the names of the institutions, and adjust the mode of regulatory intervention:

- under capitalized institutions: "a US Treasury report indicates that the industry in aggregate currently operates with a tangible net worth/ total assets of less than .5%"

- asset quality problems: "the same report reveals 23% of the industry is troubled (i.e. problem status) and that less than 1/3 of the industry has examinations rating indicative of good performance. Roughly 300 are deemed technically insolvent"

- information risk & loss of confidence: "GAP recently commented that the distortions attendant to the RAP [regulatory accounting principles] accounting 'may seriously undermine publicly confidence' in the industry...recent events in Ohio and Delaware, although involving state chartered thrifts, will taint the entire industry"

- systemic interest rate risk: "The thrift industry is acutely liability sensitive with about 70% of its funding linked to money market rates...the mortgage turnover ratio in 1983 for S&Ls was 25% (i.e. 4 years to turn the entire portfolio)"

- moral hazard: "There is growing concern as to the adequacy of the federal deposit insurance system particularly with respect to thrifts ..."

- predictable, chaotic outcomes: "Given the fragility of the industry, a rise in interest rates or other source of systemic shock could produce a situation where the regulatory capacity to prudently manage the timing & magnitude of capital requirements of the industry will be inadequate."

Each of these themes were created by that special cocktail advertised initially as a targeted social benefit whereby regulators & legislators come together with industry interests. The ability to dispense economic privilege then gets monetized, meaning that "the fix" gets put in, bad consequences arise, like a machine with a increasing harmonic vibration, and the piper comes ultimately to present a very large bill. Remember Charlie Keating and Lincoln Savings & Loan? It is the same phenomena that cost every many, woman & child some $23,000 of 1985 dollars. Remember Barney Frank, Chris Dodd & a host of others? Recall the entities previously known as Lehman Brothers or Merrill Lynch? Think of Fannie, Freddie, the Community Reinvestment Act, etc. The current forces are much broader and of greater scale and therefore uncharted. But they all have the same cause and the same effect.

The effects of distorting large scale allocations of long term capital are unknown in timing and magnitude but predictable in general form. They lower everyone's standards of living in whatever country they occur. They tend to co-exist with fraud, corruption, and a lack of property & contractual rights.

On a simplistic basis that if the cost of capital is artificially held down in manipulated markets, such as by a monopoly or regulatory power fixing the cost of money, the likely and demonstrable consequence, at least mathematically, is that asset values are overstated (cost of capital down, asset value up). Well, Treasury bonds seem to come to mind...oh, equities and real estate, too. And, because of the global role of the US$ as the global reserve currency, any other asset that has a cost of capital.

Children would understand that a restaurant that eats 91% of the hamburgers it makes is not okey dokey, although it may be a fun place to work if you like hamburgers. It cannot know the real clearing price in the local market, the real external price customers will actually bear. Politicians do not, although Chris Dodd and Countrywide seemed to have known the going inside rate (and we don’t think he’s been put under oath yet either).

The stuff of large scale capital flows and the productive management teams that make things work suffer no such illusion. Nor do investors. They know if they price wrongly, they lose money, and in fact they will. These are large scale tectonics that impact our entire national economic machinery, drive our standard of living, sustain the value of our money, and provide the opportunity for our children. And it is attempting to operate without the benefit of accurate pricing information. We know with certainty that capital allocated inefficiently or inaccurately lowers our standard of living.

So, Mr. Chairman, we shall set aside the question for now as to how & why our citizens need $49,680 of today's dollars to replicate the purchasing power of $23,000 in 1985, to ask a separate question:

What is your estimate of the costs of such distortions created by the Fed and government policy; how do you estimate them; and what is the range of error embedded in this whole process?

hb

hb

Timely. Mr. Charles Schwab, founder of Charles Schwab & Co., as in the WSJ of 2/6/2011:

Federal Reserve Chairman Ben Bernanke told lawmakers last week that fiscal policy should first "do no harm." The same can be said of monetary policy. The Fed's prolonged, "emergency" near-zero interest rate policy is now harming our economy.

The Fed policy has resulted in a huge infusion of capital into the system, creating a massive rise in liquidity but negligible movement of that money. It is sitting there, in banks all across America, unused. The multiplier effect that normally comes with a boost in liquidity remains at rock bottom. Sufficient capital is in the system to spur growth—it simply isn't being put to work fast enough.

Another manifestation of the same phenomena...

hb

hb

The revolt continues: investors refuse the risk trade. Read the lead story in today's WSJ, U.S. Sets Money-Market Plan.

Money-market funds remain susceptible to runs and to a sudden deterioration in quality of holdings, and we need to move forward with some concrete ideas for proposals to address these structural risks," SEC Chairman Mary Schapiro said in an interview last week.

Investors for months have fretted over how a Greek government-bond default might affect U.S. money-market funds. In recent months, these funds have moved to reduce their exposure to European banks, especially French ones, amid fears over their financial health.

Once the government undertook the guaranty of money market funds AND lowered the rates, the mainstay money market product became simultaneously loss and risk leaders, which is hard to do if you think about it. The government created the exact opposite of the desired outcome. Having eliminated the penalty for carrying risk, they now fret about the poor credit quality the funds carry, largely in the credit book (foreign sovereign & financial paper, some domestic banks ... and we note GE is a TBTF financial, folks)

Here's some advice, Ms Shapiro. There is plenty of demand for credit worthy corporate short term product. Investors are simply hesitant to invest in opaque financial product, black box risk containers, and rightly so. So put in place a 2 or 3 year schedule of a walk away of all federal support, direct or implied, from any money market product except Treasury Bills.

Let money funds and issuers, corporates & financials on the one hand & money managers on the other, compete for credit on the basis of price, credit risk, and information (disclosure). You will see the money flow to managers & institututions who actually know about & manage credit risk, Vanguard being one of the very best.

hb

hb

Fed Watchers See Risks in Rate Plan - "I don't know why anybody believes the Fed's forecast," Northern Trust's Mr. Kasriel said. "They didn't see the biggest recession in the postwar era coming." - chief economist Northern Trust Company

hb |

hb |  Post a Comment |

Post a Comment |  fed,

fed,  federal debt,

federal debt,  systemic risk

systemic risk

Reader Comments