Nouriel Roubini has an article in today’s Financial Times that is a must read: Mother of all carry trades faces an inevitable bust , excerpted below.

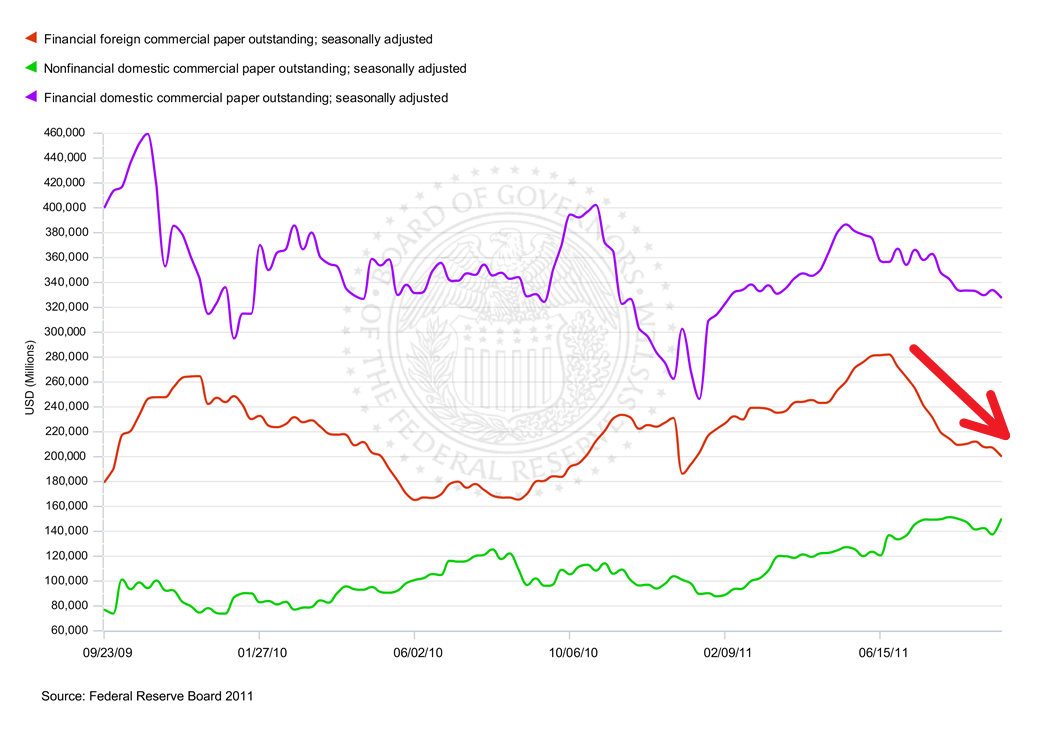

So what is behind this massive rally? Certainly it has been helped by a wave of liquidity from near-zero interest rates and quantitative easing. But a more important factor fuelling this asset bubble is the weakness of the US dollar, driven by the mother of all carry trades. The US dollar has become the major funding currency of carry trades as the Fed has kept interest rates on hold and is expected to do so for a long time. Investors who are shorting the US dollar to buy on a highly leveraged basis higher-yielding assets and other global assets are not just borrowing at zero interest rates in dollar terms; they are borrowing at very negative interest rates – as low as negative 10 or 20 per cent annualised – as the fall in the US dollar leads to massive capital gains on short dollar positions.

Let us sum up: traders are borrowing at negative 20 per cent rates to invest on a highly leveraged basis on a mass of risky global assets that are rising in price due to excess liquidity and a massive carry trade. Every investor who plays this risky game looks like a genius – even if they are just riding a huge bubble financed by a large negative cost of borrowing – as the total returns have been in the 50-70 per cent range since March.

People’s sense of the value at risk (VAR) of their aggregate portfolios ought, instead, to have been increasing due to a rising correlation of the risks between different asset classes, all of which are driven by this common monetary policy and the carry trade. In effect, it has become one big common trade – you short the dollar to buy any global risky assets.

He's got the broad structural issues right, although perhaps stated with a flair for the dramatic. Timing & rates of reaction are critical for these kinds of things: will we have a moderate point of inflection or a herd stampeding over a cliff?

A stampede will occur as closing long leveraged risky asset positions across all asset classes funded by dollar shorts triggers a co-ordinated collapse of all those risky assets – equities, commodities, emerging market asset classes and credit instruments.

I'm not sure any analyst, including the Roubini or the Fed, has a clue, or at least a valid one. My experience in the global markets has led me to believe that >80% of any liquidity (sovereign or otherwise) is determined by no more than 15 players, 3 of whom are seated next to the door, proximity to which is in order of cognitive ability. The other 12 investors are watching them. This is the stuff of which catalytic events are made. The rates of reaction can be a little slower here given the scale involved and limited options for alternative reserve currencies. But an observer of grizzly bears knows that big things may look slow but can actually move quickly, particularly when faced with threats or a prospective meal. Big things can also can grind quite finely.

Some have argued that Fed policy distorts a variety of macroeconomic factors including inflation measures, that nominal Treasury bonds less TIPS spreads are artificially low (I'm less sure on that one but am unwilling to rule it out). Roubini below argues Fed policy has induced an artificially low global volatility (although equities recently seem to contraindicate) with a tsunami of liquidity and artificially low interest rates.

The structural aspects do seem to follow a certain logic of unintended consequences that derive from the Fed's strategy of trying to manage excessively large and stupid concentrations of risk (i.e. "too-big-to-fail") by further aggregating and centralizing even greater concentrations of stupid risk.

Now, the question is, if you're the Fed,

"You're thinking...now to tell you the truth I forgot myself in all this excitement. But being this is a .44 Magnum, the most powerful handgun in the world and will blow your head clean off, you've gotta ask yourself a question: "Do I feel lucky?" - Dirty Harry

Well, do we?

The unwind could get a bit bumpy, but the point here is not to scare people but to help.

From from a practical perspective, what does this mean for investors? Our framework of bounded asset allocations, efficient diversification, and prudent risk management in many ways accomodates many of the concerns implicit here. Appropriate asset allocation is the touchstone. It is not only a measure of expected returns, but a matter of risk management. And if you find yourself inclined to changing it or second guessing things in response to market activity or headlines, stop right there. It doesn't fit or you're mis-using it.

Rebalancing is critical. In broad concept if you've had a run up of some 80-92% in equities over the last 12 months (for example China, Turkey, or Brazil) rebalancing as a mechanic would lead you naturally to sell some of the rockets and perhaps lead you to consider some that have fared less well (US regional banks were off some 27% over the same period). Similarly, foreign small caps are up nearly 50% over the same time period while US large cap value stocks weigh in at 2-4%. The same goes for fixed income: emerging markets debt and domestic high yield bonds have racked up 12 month returns in the low 40%'s, while US short bonds have gone sideways. A rebalancing in front of the US$ unwind may not be a bad thing. Rebalancing will naturally remove the excesses from the portfolio, a systematic sell high/buy low (for many of us a novel experience). Generally, this takes the portfolio in the direction you are intuitively inclined to go, but in a bounded and disciplined way.

It is very clear that now is not the time to stretch prudence in reaching for yield. Take the market rates and live within prudent risk budgets. Now is also not the time to run short on liquidity.

Stay the course with diversification. The corelations are in the words of a trader 'all kinds of screwed up' by virtue of the artifice of the Fed. It is not clear to us that anyone has an elegant solution to model and correlation risk (just ask the rating agencies), but common sense can go a long way.

Lastly, as an enterprise and portfolio matter, take a look at counterparty credit risk profiles and potentially embedded performance risks. Like it or not you've got 'em. For example, make sure you understand the operational risks of your book... like hypothecation risk in your custody agreements. On credit/counterparty performance risk I remain suspicious of whatever is highly regulated, complex, and opaque...insurance comes to mind....and for that matter Congress as well.

Saturday, July 18, 2015 at 10:39AM

Saturday, July 18, 2015 at 10:39AM  hb

hb

hb

hb

hb |

hb |  Post a Comment |

Post a Comment |  deleveraging,

deleveraging,  fed,

fed,  liquidity,

liquidity,  portfolio strategy

portfolio strategy