Q4 Review & Outlook for 2015

Tuesday, January 13, 2015 at 09:46AM

Tuesday, January 13, 2015 at 09:46AM Our intermediate term outlook is shaped by the sense that ill conceived macro policies - fiscal, monetary, tax, regulatory & social - have done large scale damage to essential components of the US economy and that recovery of the wealth creation process will be slow & increasingly risky.

The large scale damage continues to compound, and we anticipate that, best case, efforts to reform these policies will be small, slow, and incremental, generating only modest outcomes in face of a disassociated & opposed President who is more than willing to incur the economic cost to let the progressive agenda set deeper cultural roots, or rot depending on one’s view. So, we expect a continuing attempt to increase tax & regulatory burdens and expand unsustainable & unfunded social costs (nationalized health care & now education) with no concern for the debt crisis or declining standard of living which will fall to the next generation. The dead weight added to the economy will increase, but at a slower rate.

We sense that corporate earnings will be decent in 2015, perhaps up 4-6% nominally if we keep a reasonably steady state going forward. Whether earnings multiples cooperate to generate a total return of the same magnitude is an open question. We sense multiples may contract as 1) a natural response to the long bull run of the equity markets and currently fulsome valuations 2) in anticipation of rising interest rates in the US or 3) a response to particular events of geopolitical conflict.

Equally we are concerned by adverse trends in the capital markets: a growing lack of liquidity in multiple sectors; peak valuations in US equity markets; continuing “regulatory capture” or large scale rent seeking in various sectors; and increasing systemic risk. You know, the same old stuff. Illinois, New Jersey, Dodd Frank, the Fed and the Social Security Disability Fund are starting to smell like Detroit.

Lastly, we see long term damage to the culture & human capital of the country evidenced by the continuing failures of our educational system. We now have produced a generation or two of young people who are unable to participate meaningfully as citizens in modern economy. If young people don’t work, they get left behind and coalesce into a permanently dysfunctional underclass. A weak economy with failing human capital, et voila: we have the lowest levels of the labor force participation rate we’ve ever seen in the US. It is now structural, cultural, semi-literate, innumerate, and generational in nature... and subsidized.

Risks

- Volatility is back. People & markets are nervous. Liquidity is thin, dealer capital & inventories are low, and price discovery & transacting for size is more difficult. Those conditions are ripe for volatility, large scale moves in markets & economies in relatively short timeframes. Look at oil, gold, commodities, the Yen & Euro, and even US Treasuries recently. The economic analogy: a cargo ship hits a rough sea and some of the containers break loose & start sliding around. Bad things can happen. For example, the $USD is now at a 9 year high against major currencies. One thinks of problematic liquidity for $USD books of foreign banks or foreign corporations with dollar liabilities and local currency revenues (the $USD liabilities become much more costly in local currency terms). Look at the massive decline in energy prices. You’ll see more volatility, hopefully not of the chaotic variety. Regardless, the pommes frites on the Champs d’Elysee just got a lot cheaper for Americans. And so did foreign stocks by the way.

- Valuations of US equities are high: We quote James Paulsen: “Valuations of U.S. stocks are much higher today than widely perceived or as suggested by the valuation of the popular S&P 500 Index. Moreover, today’s valuation extreme is not limited only to a subset of stock market sectors but rather is very widespread whereby nearly all P/E multiple percentiles are at or close to post-war records... U.S. stocks are broadly and richly priced compared to earnings, cash flows, and book values.” - in Median NYSE Price/Earnings Multiple at Post-War RECORD, Jan. 8, 2015

- Valuations (yields) of bonds have been manipulated by the Fed to unrealistic & unsustainably low levels which have created a bubble in fixed income & other asset classes globally. The government bond markets are a mug’s game, a fixed market. It will unwind at some point and may take the form of inflation or declining standards of living. Watch Europe.

- Fed has fewer options: The Fed’s Zero Bound Interest Rates have over the last few years created negative real rates for maturities under 5~7 years. How do you lower those? Well, you go to negative nominal rates and more negative real rates. Austria, Belgium, Finland, France, Germany and the Netherlands all currently have negative nominal 2 year sovereign rates. The Fed now has far fewer options, and far less credibility.

- European & Asian economies are weak and the Grexit/PIGS are back: a never ending drama of weakness in the majors and crisis in the minors.

Positives & Upsides

- Energy prices: the huge decline in oil & energy prices is hugely stimulative to consumers and business alike and globally so. More importantly, US production has placed a long term cap on energy costs & have fundamentally lowered the long term expected price of energy.

- Global corporate balance sheets & cost structures are solid. It’s hard to overestimate the economic importance of this resilience.

- Technology: There are some amazing technologies coming to improve efficiency in virtually every sector.

- Republicans may exceed modest expectations: this would not be hard to do.

- Obama may exceed expectations: well, your call... but frankly, when pigs fly.

Equity markets1 The US equity market (VTI, in blue mountain form below, price only, 1/2/14 to 1/6/15) performed well, up 9.6%, even allowing for the declines through Jan. 6 of this year. Emerging markets (VWO) outperformed global equities (VEU in red) which suffered from weakness in developed markets, primarily Europe and Asia.

Going forward US corporate earnings in 2015 should evidence decent earnings growth, perhaps a 4-6% nominal increase over last year. However, even assuming decent earnings growth, current valuations may not hold if multiples compress. The worst case is that earnings weaken and multiples compress. We do anticipate continuing volatility. Our sense that is people are worried because it increasingly doesn’t matter how good your widgets are. What matters is Washington.

Fixed income: Below are Treasury yields for 10 year (^TNX), 5 year (^FVX) and 30 year (^TYX) indexed from Jan 2 2014 through Jan 6, 2015.

Recall how virtually everyone, including us, last year anticipated that rates would rise in connection with the anticipated recovery and the termination of QE? Everyone was wrong, not only in timing, magnitude, but even in the direction of future rates. It is an object lesson in macro market forecasting. 5 &10 year yields dropped some ~35% over the year, and long bond yields dropped ~13%. Recall this inability to forecast macro issues: write it down and tape to your refrigerator (and yes, you know who you are).

So much for the bond markets and the anticipated recovery.

If we look at the same data but expressed via prices of bond indexed funds you get a notion of the risk of big things. Think again of the loose cargo containers on the ship. The long bond, and we pick as a proxy Vanguard’s BLV (in blue mountain form below), gained some 18% over the year. Intermediate bonds, (BIV in green) likewise gained some 4.5%. Short bonds (BSV in red) went sideways and short term inflation indexed bonds (VTIP in pink) lost more than 2%.

That’s a big gain for long bonds. We note it works in reverse, too, as we may yet find out.To get an idea of what happens in a rising rate scenario, just invert the graph, that is the gains would have been transformed into losses. Think of that cargo ship on the rough sea.

Here we compare the yield curve of a year ago. We note that the US Treasury doesn't show negative real rates in the short to intermediate end of the curve. Perhaps it's a favor to the Administration to surpress "counter-narratives" also known as facts. Check out the 1/02/14 curve. It stops at 5 years and 0% real.

Commodities: Gold and oil got crushed: simple as that. Those are big negative numbers in big markets. The broader index of commodities (GSG) finished slightly negative.

Currencies: The Yen and Euro are both significantly down relative the $USD (again from Jan 2, 2014, to Jan 6, 2015. Also note the currency units are such that a rising Yen in red indicates weakness against the $USD, and as does a falling Euro in blue). These are big quick moves relative to big global economies. As we mentioned, the $USD is now at a 9 year high against all major currencies.

Volatility : ^VIX reflects shows the market's daily expectation of 30-day volatility of the S&P 500. It seems to be creeping upwards since June consistent with the volatility of the commodity and currency markets. We anticipate more volatility across markets in 2015.

Federal debt as % of GDP (log scale, to Q3 2014): out of control and no solution in sight. And, of course, the unfunded liabilities are worse. For example, the Social Security Disability Fund is set to run out of cash in 2016 and The Pension Sink Is Gulping Billions in Tax Raises.

And so much more to follow.

Labor markets (data thru Q3 2014): Notwithstanding the headline “unemployment rate” we now have near record highs of people not in the labor force and near record lows of participation by those who are in it.

The means of calculation the “unemployment rate” can be found here but the simple story is that the unemployment rate = unemployed / (employed + unemployed). If you’ve given up looking or haven’t looked for a job in 4 weeks, you don’t exist in that calculation. You are not counted, not included as unemployed. You shrunk the denominator and therefore have reduced the “unemployment rate”. Hurrah.

Uncertainty & confidence? There are no sure bets. There is only the long term framework of diversification, your asset allocation, the risk attendant to it, and the expected long term returns. In 2015 we could see a bit more of the risk than we have in the past.

As a general sentiment now is not the time to be overweight domestic equities, nor is it the time to dump & run. Recall our inability to forecast timing, magnitude or even direction with confidence? So, how about at or slightly under target?. Conversely, non-US stocks are beginning to intrigue, and we even stipulate our seemingly genetic disdain for most things European. The currency move is akin to a huge mark down on the entire continent and valuations (multiples) are more sensible.

On the fixed income side we still remain skeptical of duration and, again, we stipulate we have and are prepared to forgo higher coupons associated with it. We still favor short term investment grade bonds and are beginning to find inflation indexed attractive based on currently very low inflation expectations. Our regular readers will know that we have been averse to municipal securities due to liquidity, disclosure & credit issues, but we think that some of that dust has been priced appropriately now.

With nominal yields so low it’s hard not to notice that the stocks of many blue-chip companies have dividend yields almost double 10-year Treasury yields. We are skeptical of substituting equity risk for fixed income risk, particularly at the end of a cycle. Dividends are discretionary & get reduced when the business cycle turns ugly. The prices of those stocks respond severely. Stocks are not bonds.

Rebalancing: Our clients have been selling into the bull equity market over the last 5 years as part of our routine rebalancing discipline, so we don’t have the problem that Burton Malkiel describes in A 2015 ‘Rebalancing’ Act for Investors, but it’s a good article and well worth a read.

---

Lastly, from Bastiat, and it sounds so familiar:

“The state will perceive, first of all, the advantages to be gained from adding to the vast throng of its appointees, from multiplying the number of jobs at its disposal, from extending its patronage and electoral influence. It will not realize that, in arrogating to itself a new function, it has also placed upon itself a new, and, indeed, a frightening responsibility. For what must the immediate consequence be? The workers will no longer look upon their common treasury as property to be administered and maintained by themselves, with their own claims on it limited by the extent of its resources. Little by little they will become accustomed to considering unemployment benefits, not as something provided by the limited funds that they have accumulated by their own foresight, but as a debt that society owes them. They will never admit that society cannot pay and will never be satisfied with the benefits they receive. The state will constantly be obliged to ask for new additions to the budget. At this point, encountering opposition from the treasury officials, it will find itself in inextricable difficulties. Abuses will increase all the time, and the government will shrink, as it always does, from rectifying them until there comes the day of explosion. But when this happens, the government will discover that it has to reckon with a population that has lost the ability to act for itself, that looks to a cabinet minister or an official for everything, even its livelihood, a population whose thinking has become so warped as to have lost any notion of right, property, liberty, or justice.”

Frederic Bastiat, Economic Harmonies, Chapter 14.90

---

1 Note: all graphs are price only, from Jan 2, 2014 to Jan 6, 2015, and sourced from Yahoo unless noted otherwise.

hb

hb

We thank an astute reader for pointing out a typo which inadvertently omitted "un" before the numerator "employment" in the calculation of the unemployment rate. It has been corrected.

hb

hb

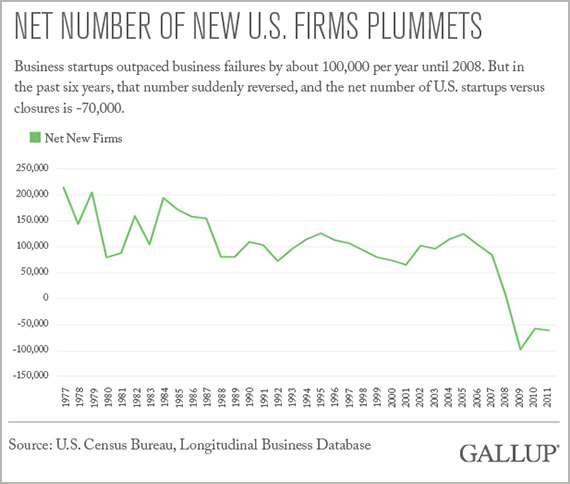

We wanted to address the issue of new business formations as a bellweather for the health of the economy, but unfortunately could not identify a decent source prior to publication. Don't you know 3 hours after we hit the go button we found this:

Gallup CEO Blasts US Leadership "The Economy Is Not Coming Back"

The problem, of course, is that declining net new firms means fewer Microsoft's, Google's ect. in the future. Anyone in commerce will tell you that small business is suffering greatly.

hb |

hb |  Post a Comment |

Post a Comment |  fed,

fed,  portfolio strategy,

portfolio strategy,  systemic risk

systemic risk

Reader Comments