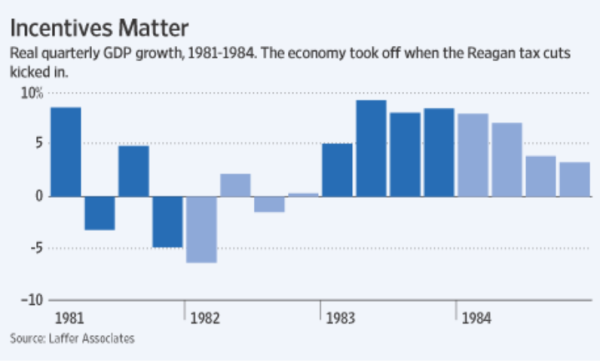

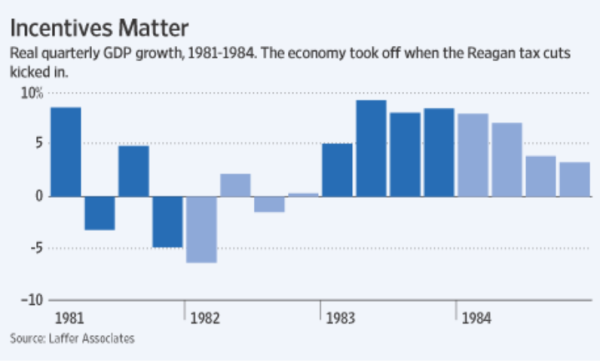

Arthur Laffer in the June 6th WSJ article, Tax Hikes and the 2011 Economic Collapse, is a sobering read and expresses a view that is increasingly difficult to dismiss. He points to the plasticity of investor behavior in respect of tax incentives. Take a look at the graph below, excerpted from the article, and consider that the Reagan tax reductions were enacted in 1981 but did not go fully effective until 1983.

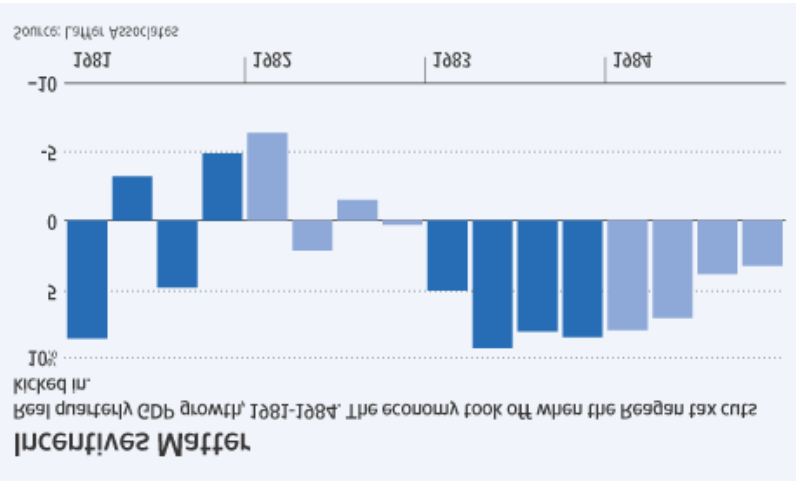

Mr. Laffer makes a compelling case that this works in reverse as well, and it's an ugly picture:

Plasticity of investor behavior is geek-speak meaning that investors tend to modify their behavior and their portfolios to accommodate changes in conditions & rules... kind of like when people move out of the way of large buses before they get hit. Well, what fast moving buses might we have?

Rising taxes - see The war on capital: yours

Nationalization of private sectors - pick a sector.

- autos – nationalized

- banking/finance - nationalized

- health care - nationalized

- education - in process

- energy – in process

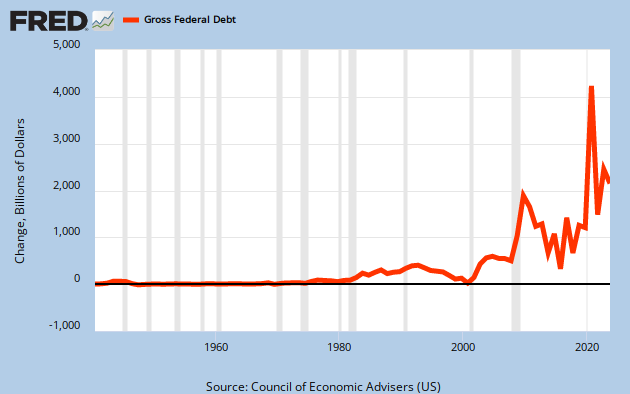

Declining macro returns on capital - Our scarce national capital has ceased to be allocated to highest & best economic uses. As national policy we see huge distortions of capital flows for losing propositions such as Cash for Clunkers; General Motors; Merrill Lynch (you do remember Merrill Lynch?); TARP; TARP II; pretty much everything on the Fed's balance sheet including AIG; the counterparty payments to foreign banks & Goldman; federal funding for Acorn; or the IMF, all of which channel capital to political rather than economic purpose. The outcome will be a lower national standard of living. Real productivity counts.

Uncertainty of rule of law & property rights - Look at the uncertainty of the rule of law and the vitiation of property rights such as in Kelo; the unprecedented & coercive settlements of claims of senior secured Chrysler & GM debt holders; the pending 'regulation' of the financial sector; or the outright unfathomable whimsy of US personal, corporate or estate tax code. 'Badges?....We don't need no badges!"

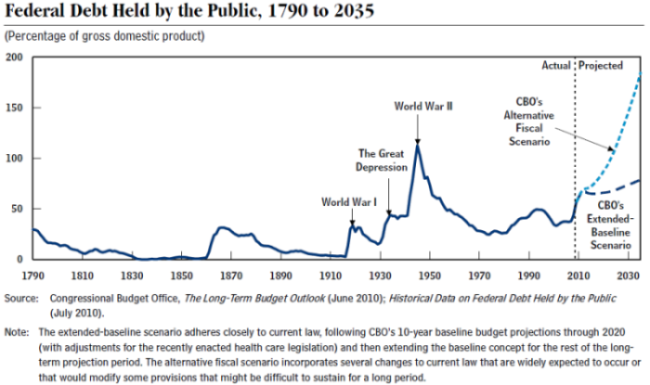

Loss of confidence- It is the loss of confidence in leadership, the current political structure, and the erosion of rule of law & property rights in the US that is currently being priced here. Risk assets in the US are now being discounted like those of a banana republic. We all know the Euro is no longer viable as a reserve currency. The price of gold indicates the US $dollar is also under pressure. Even Moody's has warned about the risk to the US's Aaa rating. This is how we create a scenario of declining macro productivity and increasing investor uncertainly. This is the impact of an endless loop of entitle, tax, issue debt, seek rent, and inflate. This is the process that will, in fact, turn Laffer's picture upside down.

That is where we are now. All these trends increase investor uncertainty, raise risk premia, lower multiples, and slow or distort the capital allocation process by which scarce resources are allocated to the highest & best uses.

Try allocating investment capital in this environment. And in fact, right in the middle of this writing, we see Bank of Montreal come out with a rather plain but extraordinary dictum: they quit.

We advocate switching out of equity positions and going to cash. The European sovereign debt crisis appears to be nowhere near over. The global credit environment is worsening. Cost of capital is going up and availability is going down. There are large gaps between where the credit market prices risk and where the equity market is priced. Equity is lagging the deterioration in credit conditions. Moves in currency, equity and commodity markets are mirroring the moves in the credit market. Global growth, in a credit-constrained environment, will slow. Profits will be squeezed by the higher cost of capital. (Focal Points, June 8, 2010, Go To Cash- In Plain English by Mark Steele

This is a non-trivial pronouncement from a generally sober Canadian institution of global stature ... these guys aren't radicals ... and it seems they'll watch from the sidelines for now. A client in the large scale excavating business asked recently in respect of portfolio management, "Every machine & piece of equipment I own has a big red button on it, an emergency shut down. Where's our red button?"

Seems like BMO just hit theirs. They got spooked and fear that the European soverign crisis will migrate to the fragile European inter bank markets, seeing tells in CDS spreads and the US$/Euro currency swap spreads (already in process). In their scenario the contagion starts in Europe, spreads to the Asian banks, which then in turn kills any global recovery. The central banks then run out of food, water, ammo, money, and ideas, and select European sovereigns & financials start to run short on US $ funding. The Fed will try to hide the symptoms, so watch the the currency swap spreads. The outstandings of foreign banks in the US commercial paper markets is the simple form of the canary in the coal mine.

Fortunately, we have our big red button, too (not yet, Bill!). Before anyone jumps, I suggest you (always) read Jim Paulsen's latest where he raises the notion of 'irrational pessimism'. He's the CIO, of Wells Capital Management, and one of the best in the business. Bob Doll, chief equity strategist for BlackRock makes good, though less convincing to my eye, relative argument in support of The Bullish Case for US Equities.

I think it's premature for the red button, but note caution and diversification are never bad things. We constantly talk about getting the risk budget right, how it translates to the appropriate asset allocation.

Many individuals and institutions simply can't afford to get it wrong. Most models assume normal distributions of returns and serial, stable correlations across asset classes over time. And in times of market stress, of course, those don't hold so well, and the only thing that rises is correlation. Keurtosis just makes a mess of everything, and all the bets come off. What makes the asset allocation process so problematic these days is that the primary determinants are now politically driven. Unintended consequences ... you know, the thrashing about of idiotic, pompous politicians can induce powerful non-linear responses of chaotic systems to create Black Swan like events. Think of Congress, the Administration, and Alfred E. Newman chiming in, "What's this button for, Captain?"

And talk about distortions, keep your eye on these:

Tax driven selling pressure: There may very well be significant selling pressure for the balance of this year brought to bear by tax regulations. Investors with embedded long term capital gains in their portfolio will see this as the last year to monitize long term gains at the 15% rate, and they will. Additionally, this year offers the last chance to roll over traditional IRA's to Roth IRA's. Investors who will probably elect the conversion will likely be executing in aggregate for size. So you have a large pool of time constrained sellers of the net tax liability due on conversion. All should should plan their tax and liquidity book well in advance. A fellow doesn't want to be the last one through the door in December, particularly if the banks, foreign or otherwise, are having a tough time with year end liquidity.

Fixed income dilemma: Short rates offer little to negative returns, but our thought (or more accurately, bias) is that now is not the time to buy duration or risk in search of yield. Be patient, stay short to intermediate term with a bias to high & investment grade credits. Any retake of aggregate demand will stoke inflation fears, and people will find out what duration means. The counter trend is that the Euro is no longer viable as a reserve currency, which presumably will stoke the bid for US Treasuries (buy a drunk a drink?) and any further geopolitical conflict will drive the 10 year Treasury to less than 3%. Just to make things worse, just as you see the concern shift from deflation to inflation, you will likely see the correlations of bond and stock markets reverse.

So, two days after BMO tells the world to go to cash, the market is up ~200 points ... ummm, make that 270 now. Perhaps a bad day for them, but if they're in cash they can go home early. Go figure.

(WWB does not offer legal or tax advice and nothing herein shall be so contrued.)

Monday, October 25, 2010 at 04:04PM

Monday, October 25, 2010 at 04:04PM  hb |

hb |  Post a Comment |

Post a Comment |

.

.