We’ve run silent for a while with good cause. Those with whom we speak know our distraction with and consternation about some corporate governance issues well away from WWB. Our homily for last two quarters is, like QE3, ubiquitous: know before you go. More on that later.

The core issue for our silence has been that we've had nothing to say, at least nothing that made any particular sense. We were mesmerized by the magnitude of the geopolitical & macroeconomic frogs in global blenders and by the scale of cynicism marking the political hegemony. What is it, "if you can't say anything nice, don't say anything"... well, our readers know we missed that bus a long time ago.

.

We have accelerated the quarterly review process for our clients because we wanted to be tucked in before the end of this quarter in light of the election and the potentially massive recasting of portfolios driven by tax windows and political outcomes.

.

Talk to your tax advisors now

We suggest all check with their tax advisors to get a grip on their expected marginal tax rates next year; review any embedded long term capital gains and implications of future rates; and make sure you have adequate liquidity to tide over any potential geopolitical stress or untoward political outcomes domestically.

QE3: Who made the Fed the 4th branch of government?

The Fed has manipulated the rates for some time and now with the advent of QE3 the price of money will be determined by fiat of the Fed, whether driven by putatively leading economic thought, whimsy, or political objectives... exactly the same way FDR did in 1933. Amity Shlaes wrote a fascinating article in the WSJ on FDR and the notion of confidence, part of which is excerpted below:

Over the summer of 1933 ... Roosevelt launched a novel gold purchase program. The plan was to drive up the general price level by buying gold. Each morning, FDR set the gold price target, personally ... theoretically, Roosevelt's idea of reflating can be defended... but the exposure to investors that Morgenthau was getting through the gold purchase project of 1933 was already teaching him something. Investors didn't like the arbitrariness. It took away their confidence. One day Morgenthau asked FDR why the president had chosen to drive up the price of gold by 21 cents. The president cavalierly said he'd done that because 21 was seven times three, and three was a lucky number.

FDR, Obama and Confidence

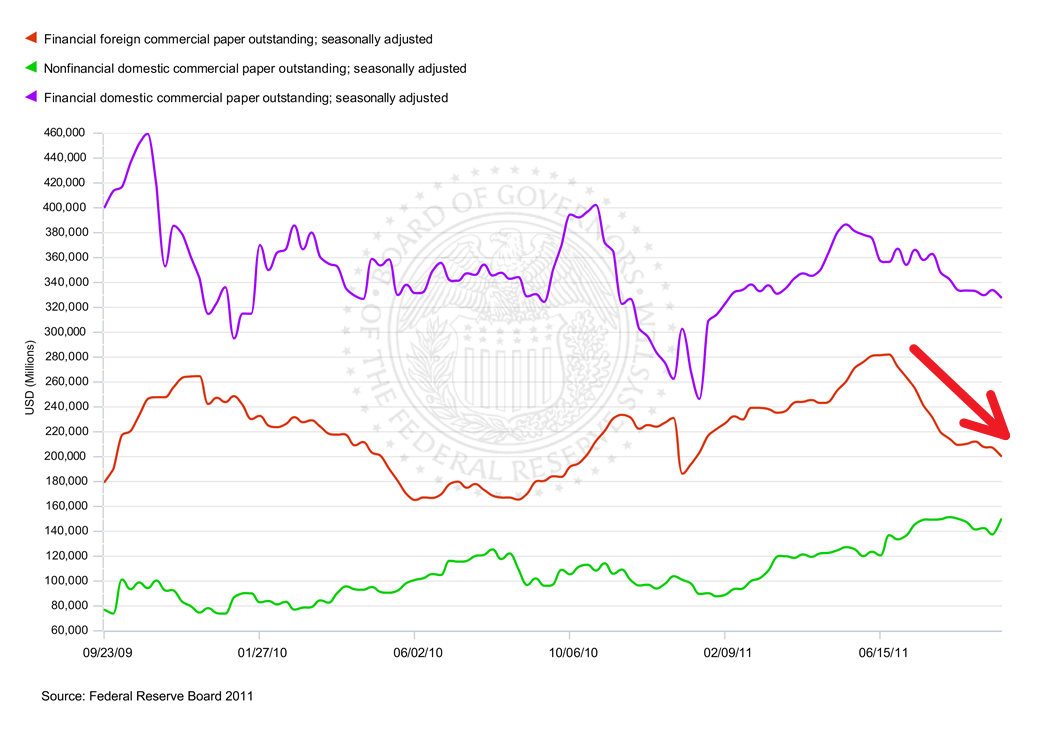

That’s Bernanke today, and as we’ve said before “One might then reasonably inquire as to how and on what rational basis ... other than that to be found in a room, dimly lit by burning candles, with chalk pentangles and splatters of chicken blood on the floor ... how do they evaluate risk of this market which funds, essentially, the entire financial system of the known world.”

The consequence of artificially low rates is a wealth transfer from the investor (you) to borrowers. Crudely put, you get low to no interest income while borrowers get low to no interest expense. Good for borrowers, bad for investors including retirees, your mom & dad, pensions, or anyone who wants to start saving…like young people with or without families. These are big, large scale numbers with generational implications for capital formation. The low yields are only one small part of the silent transfer of wealth & risk that is ongoing.

Let’s talk about risk, shall we?

In fixed income risk comes in two forms, duration & credit. Fed policy is attempting to force investors to load up on both. We all know what credit risk is: the weasel is shaky or doesn’t pay you back (Greece or General Motors come to mind, yes? Junk bonds? Your esteemed Uncle?). Duration is a measure of interest rate risk. So, for simple example, if you have duration of 14 as many long term Treasury funds do, and 14 year rates go up 1%, you just lost 14% of the value of your bonds. If the rates go up by 2%, then you lose 28% of your value (kind of a big numbers for purportedly low risk investments, don’t you think?). This is a big deal.

In fixed income there are only two sources of yield: duration or credit risk (let's ignore liquidity premia for the moment). Oh, by the way, these price changes and risk parameters move instantaneously with expectations, so the bond manager (or you the investor) needs to ask if he feels lucky today? Will the center hold? Long enough for me to pick up another coupon payment before expectations collapse? Well … do you? Or maybe your grandmother shouldn’t own all those long term bond funds? The Fed is force feeding markets. The investor who stays short forgoes yield, and retail investor who goes long does so by incurring duration risk. It will not end well.

Inflation risk

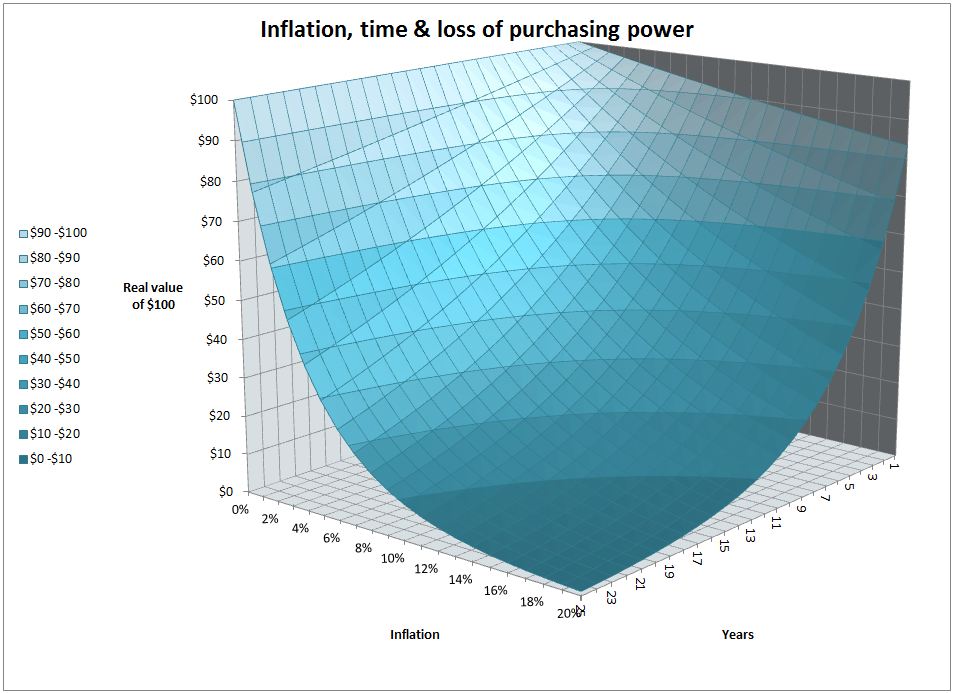

Ah, the printing press. Another component of QE3 is the hidden cost of inflation, that part of price changes induced by excess money supply. When you look at the chart below, recall that Jimmy Carter took the title, as it were, with 14.8% inflation in March of 1980. It can & did happen. When you have monetary & fiscal policy created by the belief that $1.00 of government spending creates $1.50 of GDP and that belief continues to drive policy absent supportive data or in fact even in face of contra-indication… you may have a problem, particularly when you’re borrowing $.40 of each $1.00 you spend.

As you look at the graph below imagine it to be 3 sides of cardboard box with two walls and the top cut away. We drape a light blue cloth (a “surface” in math speak) along the upper left hand wall. Go the far upper corner where we start at $100 at time 0 with 0% inflation. You can see the real value stays at $100 where ever you are on the time line at 0% inflation. The front left axis of the floor of the box is the level of inflation running from 0 to 20%, and front right axis is time in years. Go to the rear wall, pick a line on the cloth (the first one is 1% inflation), and slide down the time line across the drape to the front. Presto! You get something less than $80 in real value at 1% inflation over 25 years.

Just so you know, the low points (closest to you, lower center, darker blue shade are the longest timeframes & higher inflation rates) represent about $1 of real value. You get the picture of a pretty severe loss of value over time even with fairly modest inflation: 3% inflation over 25 years kills half your purchasing power. That’s a big deal for individuals planning their retirement or for anyone including insurance companies or banks or corporations trying to fund assets or liabilities in the future. It’s a very difficult box to get out of.

the men would get paid in the morning. they would take pillow cases, put the cash in the pillow cases, walk over to the wall, and throw the bags of money over the wall to the women who would go out shopping, to spend the money before the merchants raised the prices in the afternoon...

source: as told to my friend LG by his grandfather on life in the Weimar Republic

Just witness the 25 basis point surge in break evens in the hours following the Fed’s QE3 announcement on Thursday last week, representing a “5-sigma event” for this market-measure of inflationary expectations.

source: Mohamed El Erian in Introducing the “reverse Volcker moment” Sept. 20, 2012

As you look at the graph ask yourself how do I price assets of any kind when I’m looking at a surface of real value that declines like a large water slide at an amusement park? This is how government lowers our standard of living. It is how government levies taxes without the consent or vote of the people. No elected official “votes” for “Quantitative Easing”. Who made these clowns the Fed an unelected 4th branch of government? … but we digress into outright political control of the broad market economy.

There are very few places to hide, and those are imperfect places. This is not a pleasant time to be either an investor or in the investment management business. The general form of problem is that the Fed has manipulated the “risk free” rate to zero and announced it will print money without limit of time or amount. This causes two tectonic problems. It distorts asset price information and induces inflation risk.

Real yields for US Treasuries with maturities less than 20 years are negative. This is the bond bubble. What value could there be in a 20 year bond with a real yield of 0%? We suspect very little positive value and potentially significant negative value. How shall we know? Ask Ben.

The problem of the “bond bubble” does not stop with bonds. The US$ is the global reserve currency, and the US Treasury market sets the benchmark for global asset pricing. As the Fed pushes investors out the “risk curve” the distortion of the Treasury market ripples across the globe and across prices of all asset classes.

Recall that in response to instability of Euroland we saw investor flight out of the Euro and into the US$ and Treasuries which became too expensive, no yield, then catching its breath, the herd swarms into emerging markets debt & high yield debt which became too expensive, then into US equities generally, and particularly dividend paying stocks, which perhaps have become too expensive, or onto real estate which was previously too expensive and the proximate cause of the initial collapse? Or commodities that reside in bins? Or gold which has no earnings, no P/E ratio? The uroboros eats its own tail.

Add to this the uncertainty of the entire tax code, regulatory framework, the outcome of the US election, clueless Europe, Islamic instability on fire globally, with what appears more & more each day as a failed state on our southern border, not to mention the one in Washington.

Investment strategy

Our view has been that inflation is the primary risk to investors and that view defines portfolio & risk strategy. Of course, the solution is sustainable high real returns but there just isn’t a perfect solution, and there are no risk free solutions. An optimal strategy likely takes a form of ‘least worst’. Our general preference in relative order would include equities, real estate, commodities, short Treasury bills, inflation indexed bonds, and short duration spread product, all defined within prudent diversification and risk parameters.

Asset allocation

We do not anticipate significant changes in terms of existing broad asset allocations for most clients. That work has already been done & is embedded in the existing portfolios. We will be inclined to increase our exposures to real assets beyond the positions embedded in existing index product by adding slices of gold or silver, the size of which will vary by client risk tolerance.

On a good day the asset allocation decision already incorporates one’s ability to tolerate risk. We see nothing on a macro basis that would induce us to start adjusting those dials significantly for our clients. Risk tolerance will be the driver.

.

Fixed income

As a general comment we’ve had a legacy core bias to short duration investment grade credit augmented by moderate positions of inflation indexed product, emerging markets debt, and domestic high yield. We’re still inclined to avoid duration and favor short Treasury Bills, inflation indexed bonds, short investment grade spread product. We’re not buyers of high yield or emerging markets debt at these levels. We’re content to hold for now.

.

We’re scared to death of municipal credits but suspect there may be value in certain long duration AAA/Aaa floating rate municipals. Ah, wouldn’t we all like to float or drift as the case may be?

Solutions to the inflation challenge can be problematic in that many investors simply lack the scale to tolerate the risks associated with the most robust effective classes or lack access to solutions which reside in the capital markets (e.g. interest rate swaps). What can we say, scale counts: “It’s good to be the king.”

Why not increase equity exposures?

By all means if you've got the risk budget and faith in Ben. It has been a significant 3 months for virtually anything: US equities, non-US equities, emerging markets, and gold. QE3 in connection with a slow grinding economy can do wonders. So do steroids, but there are bad side effects.

While we believe that equities represent the best shot at sustaining higher real returns over time, we also recall the notion of Mr. Bernanke forcing investors out the risk curve. He has made some very large scale bets on a questionable basis. If it ends badly, the equity markets globally may be damaged or radically repriced along with all the guinea pigs herded out the risk curve.

We suspect the Treasury “bubble” has become ubiquitous, spreading to virtually all asset classes globally including equities. Historically, the US equity markets have been characterized by the stability created by a permanent equity market & investor class. Neither Asia, Europe, nor the emerging markets can make that claim credibly. In a heart beat…poof… they can go. Such things happen in panics. US equities traditionally have stayed, we were open for business after 9-11.

But things change. We started by saying that we view inflation as the primary risk. But are we not in a growth constrained and credit stressed environment too? The tertiary risk is an untimely, chaotic repricing of the distortions induced into the markets by imprudent fiscal policies & coercive & synchronized monetary policies globally. The risk is that Bernanke, the US Treasury, Congress, and the President, perhaps in conjunction with exogenous forces, unwittingly damage the fabric of the US capital markets and the investor class. We no longer assign a de minimis risk to that outcome. It's already started.

Look at what they did to our bond ratings.

Thursday, January 31, 2013 at 10:25AM

Thursday, January 31, 2013 at 10:25AM  hb |

hb |  Post a Comment |

Post a Comment |