Let’s start with fixed income and look at some pictures.

One year look back at 5, 10 & 30 year Treasury yields: 5 (blue), 10 (red), and 30 (green) years all indexed to inception date:

5’s and 10’s had significant moves over the last year while the 30 year has been remarkably stable. The middle of the curve, 5 years, took a fairly dramatic move upwards. No one who owned duration was particularly happy. We suspect a slow and modest grind upwards, notwithstanding and ever mindful of Ms. Yellen.

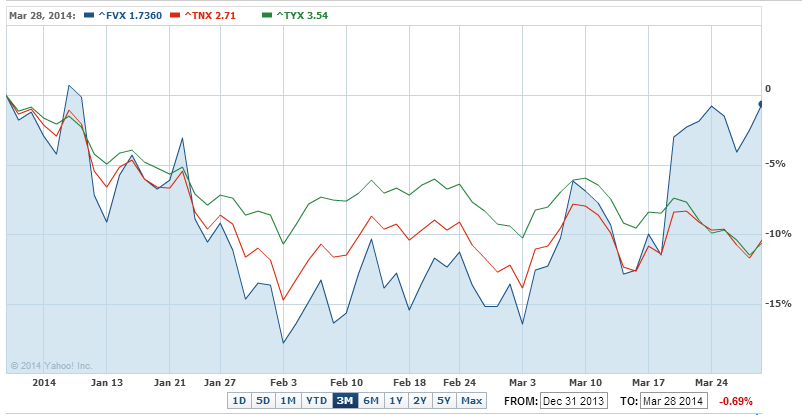

Changing the perspective to the last 3 months as pictured below gives a dramatically different picture, one that reflects convergence of three sources of uncertainty

-

the start of Yellen’s tenure

-

the macro regulatory & policy uncertainty that seems to continually cloud the economic outlook. Is the economy picking up? Do we have naturally increasing demand for money that derives from an expanding economy? Or do we have a whiff of no growth or even deflation?

-

lastly, the geopolitical instability in Crimea that came to a head, don’t you know, in February (see below).

We see this three month period as more interesting than iconic or dispositive, but we see none of these broader factors mitigating in the near to intermediate term. Note the same relative volatility focused on 5 year Treasury yields which led the way down and up. A three month lookback with the same color scheme as above.

We can’t do any better at defining fog, so we’ll quote Ms. Yellen’s first FMOC statement:

The Committee will closely monitor incoming information on economic and financial developments in coming months and will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. ... asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases.

In determining how long to maintain the current 0 to 1/4 percent target range for the federal funds rate, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments.

With the unemployment rate nearing 6-1/2 percent, the Committee has updated its forward guidance.

Our take: the FMOC will not say what it really means which we translate as “we will do whatever we feel like.” No rules based policies here, so don’t look for any, and while that may seem helpful to the current administration, it is not helpful to the productive direction of global capital flows.

Now that we have that sorted out, ladies and gentlemen, place your bets. And that’s where we are. We will defer until later the implications for fixed income strategy, but Putin seems more predictable than our domestic monetary policy.

Equity markets: let’s take a longer term look at the broad domestic US (VTI in blue) and foreign equity markets (VEU in red) first. These are big numbers. Those who sold at the bottom out of fear suffered huge & permanent impairment.

We are five years in to a significant bull run built on the weakest recovery since the Great Depression. How long do these things run? Not forever.

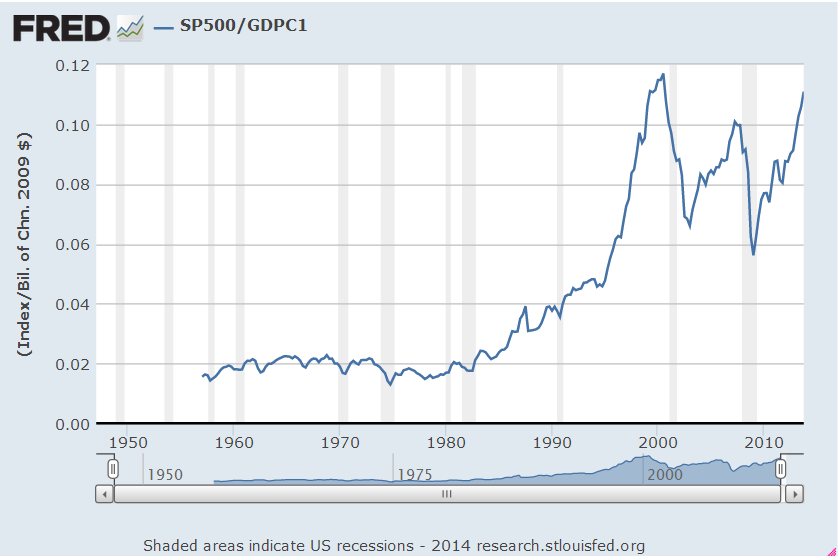

Certainly equities are not cheap and by some metrics fully priced as the time series below of the S&P index priced to real GDP suggests. Or maybe not if the shale and fracking boom, not to mention genomics, are finally incorporated into a sane North American centric political and geostrategy that redirects petro$ capital flows & investment back here?

S&P 500 Index/real GDP

If you are sobered by the chart above, there is another perspective. Consider that on March 24, 2000, the S&P was at 1,527. As of this writing it stands at 1,889. Have we only added 362 points or ~23% of value in almost a decade and a half?

We do consider the hypotheses that uncertainty has slowed the rates of economic reaction, that

-

policy and regulatory uncertainty has slowed the recovery materially and may have the consequence of extending the tenor of recovery beyond normal timeframes?

-

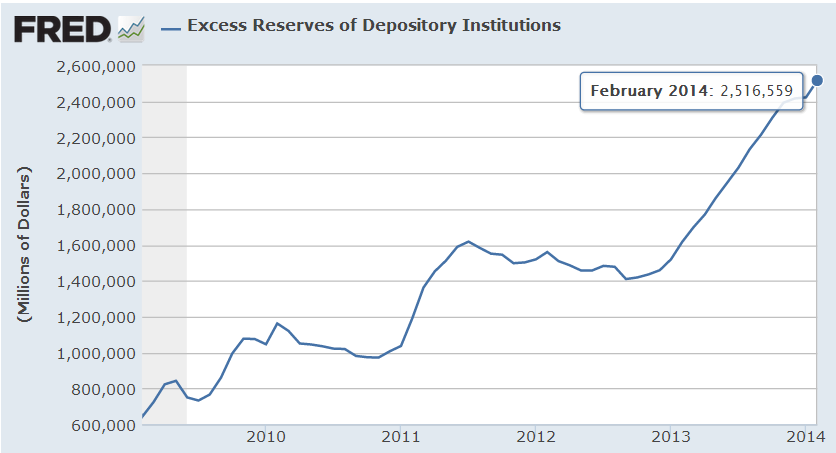

monetary velocity is already starting to heat up, that transactional demand and excess liquidity of the banks can quickly cause a run up in money supply?

-

if so, will the Fed in turn get spooked or more likely be forced by the rational market bond vigilantes to increase interest rates in a hasty and defensive move?

Note the last data point above is Q4 2013. You can’t get much lower in terms of money velocity and still keep breathing, nor, as you can see below, can you get much more gunpowder stuffed into the cannon of excess bank reserves.

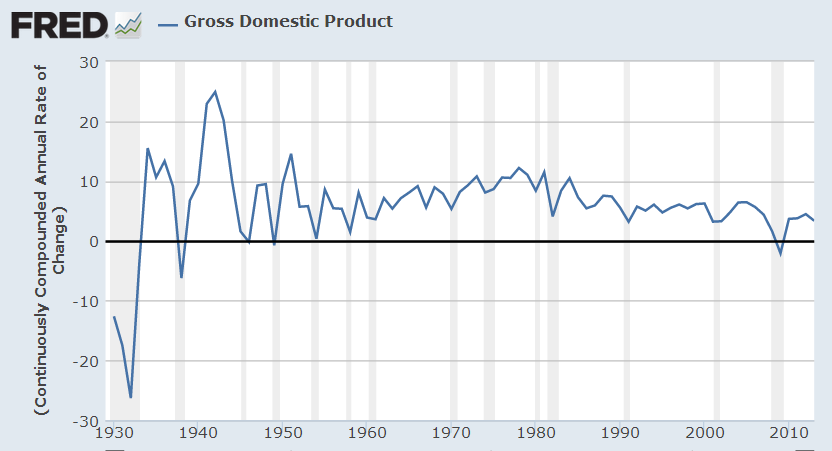

GDP checks in at a 3.36% continuously compounded rate as of last and endlessly adjusted data available on 3/27/2014. This suggests some slow but residual tectonic strength in the economy.

Our loyal readers know that we have wondered though how you get a sustainable economic recovery with weak employment, hence weak consumer demand, hence weak capital expenditures to fulfill it. A known unknown as Mr. Rumsfeld would say.

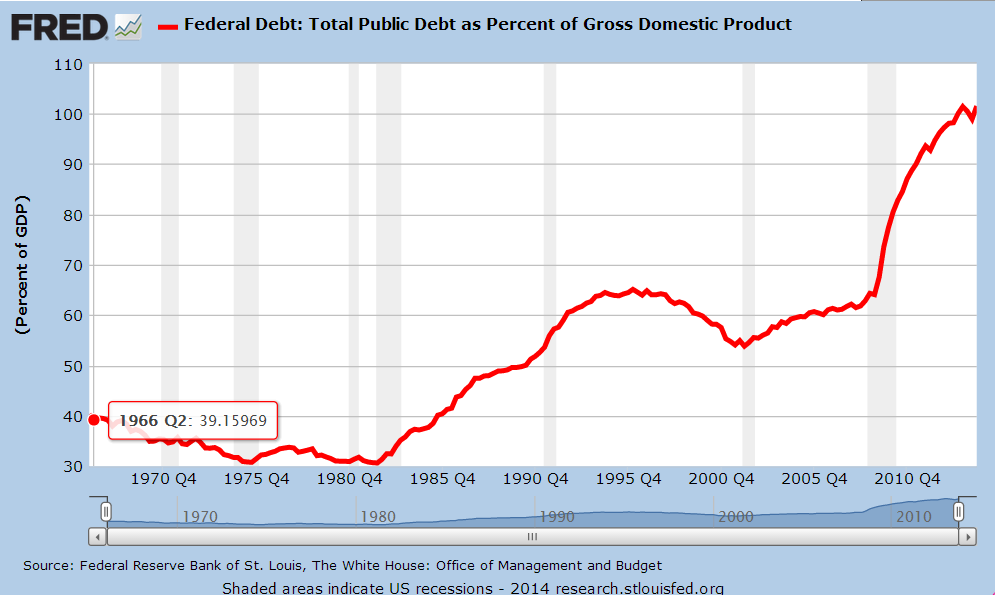

And we are unwilling to exercise fiscal discipline: we are over levered and this problem will continue to compound until it is solved.

Conclusion

There are significant cross currents that make it difficult if not impossible to suss out reliable themes: we have none, at least with conviction. These wheels grind slowly.

We retain our focus on risk, so we again emphasize the importance of the asset allocation and diversification. We acknowledge the bull run of the equity market is getting long in the tooth but suspect there is more to go.

Given the likelihood of ongoing domestic political paralysis the major risk to the equity markets comes from the fixed income market where the equilibrium is delicate. If money velocity kicks up the Fed may be forced to respond quickly and a chaotic repricing may ensue. On the other hand, if the Fed stays wedded for too long to the QE mechanic & manipulation of rates or is perceived to back off from the unwind, a shoving match may break out again between the Fed and the rational market players as happened on Bernanke's first foray into the taper scenario. The lack of clarity from the Fed is not helpful to avoiding the volatility of either outcome. We leave you to speculate on the odds of a perfect landing....

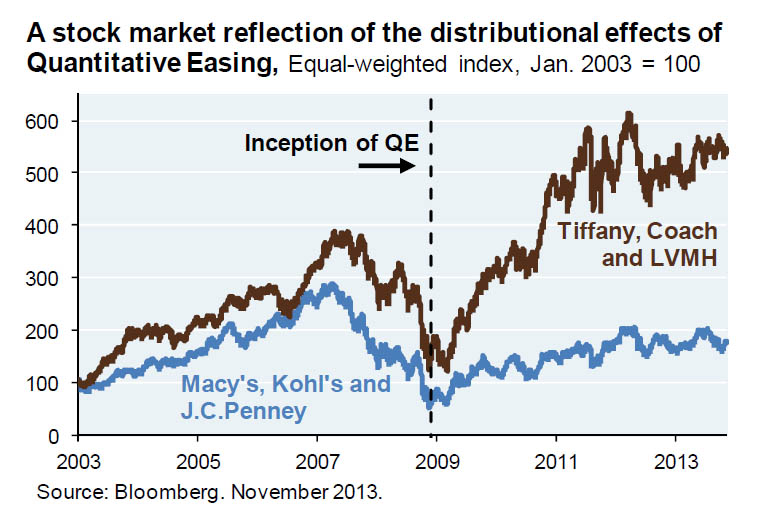

So the question for equities is how do you price a seasoned, though continuing, weak domestic recovery marked by weak employment and lower levels of capital expenditure and low growth. Can the Fed juice equities more in the short term? Probably. They’ve done it for a while. Can we have a robust and prosperous economy in the long term on our current trajectory? Probably not. We know what that economy looks like:

source: Zero Hedge

The costs of Obamacare will dramatically increase and that may not be fully priced into equities yet. Europe and the emerging markets seem to be synchronized in their indigestion. Europe shows no sign of significant reform. Asia has asset quality problems, but perhaps more political elasticity to solve them. We still think domestic US growth for 2014 will end up around 2-3%. We may be low. We hope so.

Lastly, we draw your attention to two important articles: New, Revolutionary Way To Measure The Economy Is Coming -- Believe Me, This Is A Big Deal. It involves a new metric, an alternative to GDP and perhaps more accurate view of the economy:

The statistic is called Gross Output and will be issued by the Bureau of Economic Analysis (housed within the Commerce Department) .... Why is GO such a big deal? Because it measures the economy in a far more comprehensive and accurate manner. GDP represents the value of all final products and services. It ignores all the steps that go into the making of these things. It’s sort of like looking at a carton of milk and paying no heed to everything that goes into creating that milk and getting the carton onto the store shelf.

GDP thus gives a distorted picture of the economy. How many times do we read that consumption represents 70% of the economy and therefore it’s important to “stimulate demand” by increasing government spending?

In figuring GDP, government spending is said to represent 20% of the economy, investment a measly 13%. (Incredibly, imports are counted as a negative for the economy and subtract 3% from GDP. Protectionists love this absurdity.)

GO counts all the intermediate steps in the making of products and services. The results are stunning: Consumption is 40% of the economy, not 70%; government outlays are down to 9%; and business spending soars to 50%.

It begs a reevaluation of cause & effect. Does healthy consumer spending create a robust economy or vice versa? Does cancer cause smoking or vice versa? GO presents, potentially, a re-ordering of the major components, perhaps the priorities that might be appropriate from a policy perspective, of the economy. Keep an eye on this. What if we were delivering all that wonderful stimulus to the wrong place and in the wrong way?

And just for current events, if you want to get schooled on the high frequency trading stuff we recommend Cochrane’s posting Budish, Cramton and Shim on High Frequency Trading which will prep you for an in depth paper he cites, The High-Frequency Trading Arms Race. Good luck.

hb

Thursday, July 24, 2014 at 11:56AM

Thursday, July 24, 2014 at 11:56AM  hb

hb

hb

hb

hb

hb

hb

hb

hb

hb

hb

hb

hb |

hb |  Post a Comment |

Post a Comment |